Best Of The Best Tips About How To Find Out Cost Basis

Once you have done that step, you then deduct your basis in the property to determine whether you have a gain or loss.

How to find out cost basis. To understand what the cost basis is, take a look at this formula. First, it’s important to know that basis is the amount of your capital investment in a property and is used for tax purposes. To find the adjusted basis:

If your best estimate is a date range rather than a specific date, use the historical prices at the start date and end date of that time frame to come up with an average stock price. Here are three tips that finra suggests for keeping track of cost basis when buying and selling stocks: How do i find a stock's cost basis?

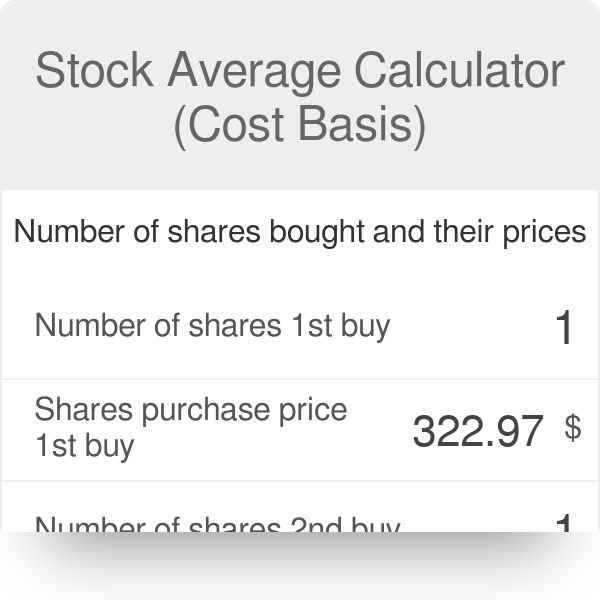

Sign in to your brokerage account. Since you “paid” $1,119 and you own 112 shares, we calculate your cost basis by dividing $1,119 by 112. If you do the math, you’ll see that the cost basis is now $9.99 per share.

Mutual fund investors have one additional cost basis method they can use called “average cost, single category.”. Thus, if you have $500 in dividends reinvested and it buys you 30 additional shares, your. Cost basis options for mutual funds.

Know what “cost basis” means. Now here is where it gets more fun, as your basis. How is cost basis calculated?

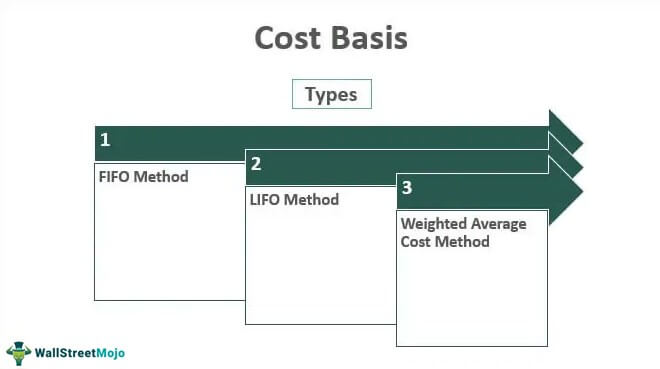

It is usually calculated starting with the purchase. The irs generally identifies two methods for calculating cost basis. The cost basis is the amount that you spent to acquire an asset, including the purchase price, transaction fees, brokerage commissions, and any other relevant cost.

/GettyImages-187569189-5c497c1cb19141b4aea3488073f808a8.jpg)