Real Info About How To Fight Wage Garnishment

Once that happens, then the judgment creditor must file papers with the court to start.

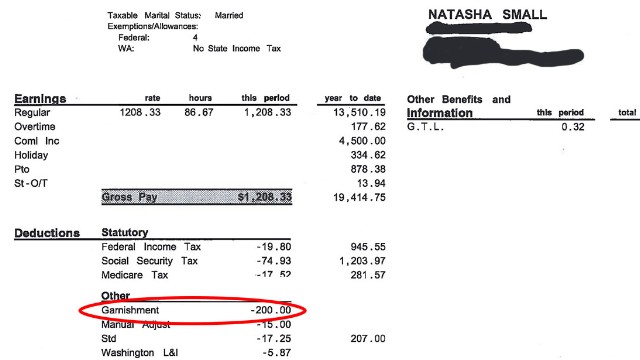

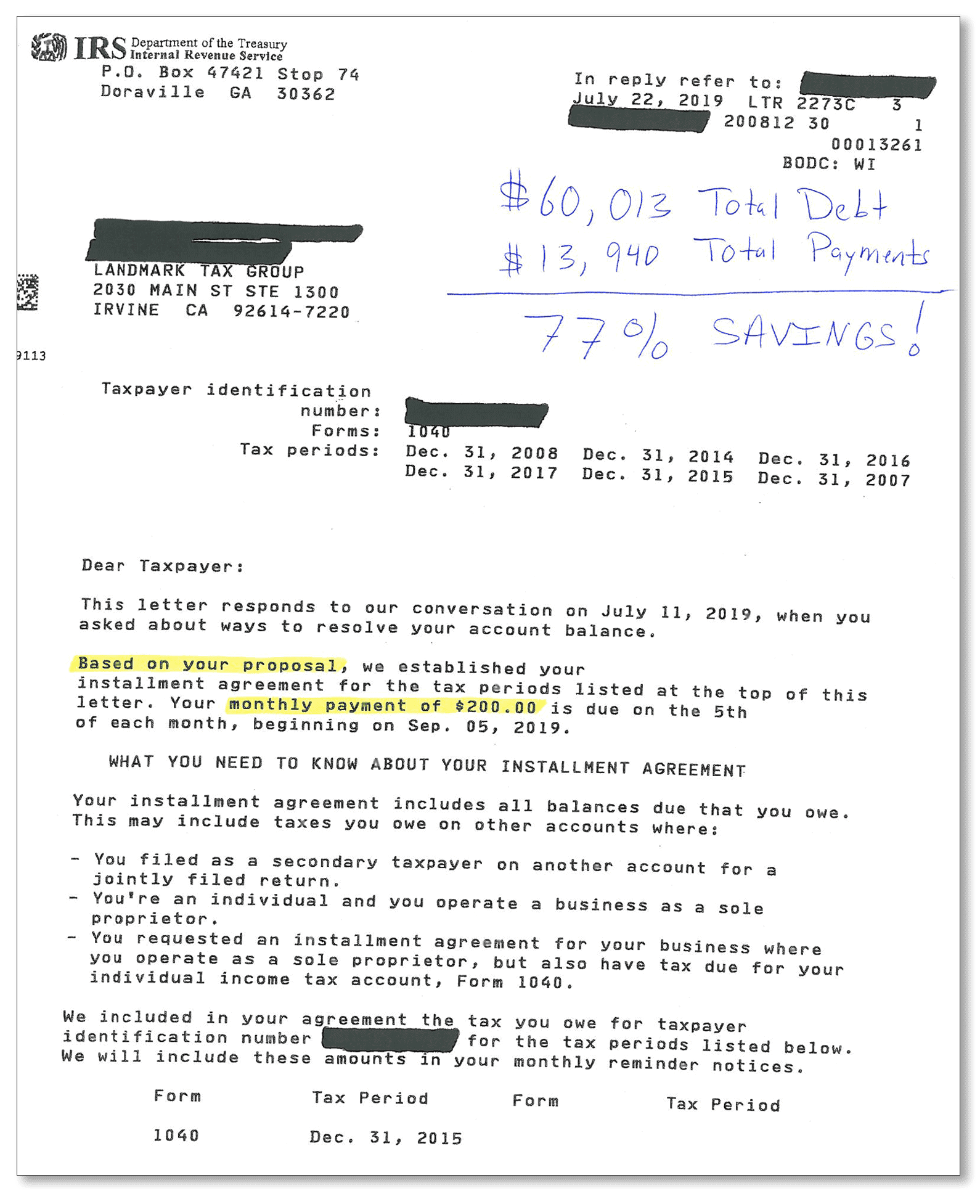

How to fight wage garnishment. As part of the irs collection process, the irs may file a notice of levy on your property. One of the quickest and most effective ways to stop or reduce a wage garnishment is to contact the creditor yourself. What you need to do objecting to the garnishment is about proving your legal eligibility for a change to or reversal of the judgment.

Once a creditor has obtained a judgment against you, many states. If you believe you have grounds to. Request a hearing to dispute the garnishment.

How to stop irs wage garnishment. Ad our experienced firm can help you with judgment contests, settlements, & liens! Immediately after a chapter 7 or chapter 13 bankruptcy case is filed an automatic stay will be enacted.

If you are considering fighting a wage garnishment, you may want to hire an attorney. When a creditor initiates the process of garnishing your wages, they must send you a notice to that effect. The automatic stay requires all.

3 best ways to fight wage garnishment september 14, 2021 personal finance first of all, try to work out a payment plan with the lender because it can solve all problems. Bankruptcy is another option for stopping wage garnishments. In some states, the amount of the garnishment can be reduced or eliminated if the debtor argues that paying the garnishment would cause an undue financial hardship.

List the evidence you have and request that it stop the. Learn more now, contact us for info or to book your free consult! Up to 25% cash back instead, it must first sue you and get a judgment against you from a court.